foreign gift tax canada

Person from a foreign person that the recipient treats as a gift and can exclude from gross income. While the value of the gifts is.

Canada Tax Income Taxes In Canada Tax Foundation

The gift tax rates range from 18 to 40 and reach the highest rate at 1 million of value.

. You will have to complete form T1135 to report your assets outside of Canada. The Canada Revenue Agency has no gift tax in Canada so if you have given or received money from someone there is no tax to be paid on this amount. The IRS defines a foreign gift is money or other property received by a US.

The amount that qualifies for the tax credit is limited to 75 of your net income. If you are a US. In addition to the unified exemption both US.

My father has sold one of his businesses in homeland outside Canada and he decided to give me and my brother cretin. You can view this publication in. Foreign Gift Tax Canada.

In addition gifts from foreign corporations or partnerships are subject. Citizen receive gifts or bequests from. 16 rows Estate Gift Tax Treaties International US.

P113 Gifts and Income Tax 2021. Enter the eligible amount on line 32900 of Schedule 9 Donations and Gifts. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate.

There is no gift tax in canada so when your children receive gifts they. Gifting a capital property such as real estate shares bonds patents or trademarks entails a slightly different type of tax consequences. Under section 1181 of the Income Tax Act tax credits can be claimed if a taxpayer makes a gift to a qualified donee such as registered charities and registered.

Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and. But a key exception is when a foreign person Non-Resident Alien or NRA gifts US. This reporting rule is the purpose of Form 3520 which is the form you must file with the Internal Revenue Service IRS when you a US.

The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the. Canadian tax law divides gifts into taxable and nontaxable categories. Canada does not impose a gift tax or an estate tax.

Depending on the type of gift the gift giver may have to pay the capital. Monetary gifts to Canada should be. Domiciliaries have an annual.

In addition there is also no deductible. Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax. As to the taxation of foreign gifts the general rule is that gifts from foreign persons are not taxed.

Canadians do not pay tax on foreign inheritances received. Any interest income earned on. The amount that qualifies for the tax credit is limited to 75 of your net income.

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Sending Money Overseas Tax Implications Wise Formerly Transferwise

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Tax Guide For Canadians Buying U S Real Estate Madan Ca

U S Estate Tax For Canadians Manulife Investment Management

/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)

Canada Vs U S Tax Rates Do Canadians Pay More

Canada Tax Income Taxes In Canada Tax Foundation

Foreign Tax Credits For Canadians Madan Ca

International Tax Treaty Canada Freeman Law Jdsupra

Taxes For Canadian Citizens Living In The Us 101 Tfx

The Gift Tax Turbotax Tax Tips Videos

The Estate Tax And Lifetime Gifting Charles Schwab

Us Tax Guide For Foreign Nationals Gw Carter Ltd

2021 International Tax Competitiveness Index Tax Foundation

Applying For A U S Tax Identification Number Itin From Canada Us Canadian Cross Border Tax Service Cross Border Financial Professional Corporation

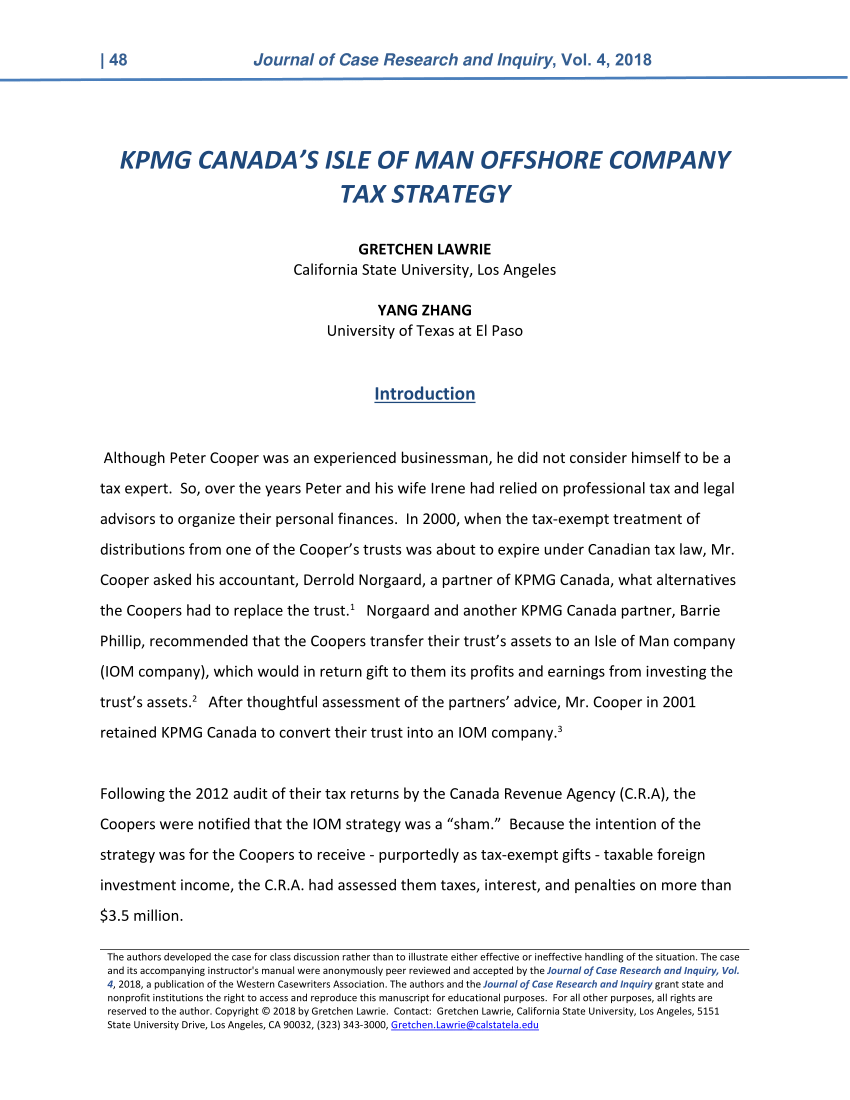

Pdf Kpmg Canada S Isle Of Man Offshore Company Tax Strategy

Sending Large Money Transfers To Canada Tax Laws To Know Finder Com

Taxes For Canadian Citizens Living In The Us 101 Tfx

Canada Moves To Ban Foreign Real Estate Buyers For Two Years The New York Times